Medicare is comprised of four parts and ten plans to provide choice for each individual in the US to balance preferred medical coverage and cost. In general, it is recommended to choose the most comprehensive coverage that falls within your budget.

Medicare Enrollment

Age 65 is when enrollment for Medicare should occur. The enrollment window starts during the 3 months before your 65th birth month and remains open until 3 months after your 65th birth month, for a total window of 7 months. To enroll, you must contact the Social Security Administration personally and request enrollment. Failure to properly enroll during this open enrollment period can result in lifelong penalties and seriously limit choice of plans and options in the future. Therefore, every effort should be made to be fully informed and enrolled during the open enrollment period.

Enrollment Exceptions

If a person is already enrolled in Social Security prior to the age 65 enrollment window for Medicare, then they will automatically be enrolled in traditional Medicare. However, plan and option choices that differ from traditional Medicare must still be made by direct action of the individual during the open enrollment period.

If a person is employed by a company with more than 20 employees and is provided by the employer with medical insurance coverage, then enrollment in Medicare can be deferred after age 65 up to 8 months following termination of employment. While in this circumstance it is still possible to enroll in Medicare at age 65, it typically does not make sense to do so and incur the associated monthly charges while employer medical coverage is in effect.

An additional exception is for certain people under age 65 with disabilities who are eligible for early Medicare enrollment.

Medicare Parts A,B,C,D

Medicare is comprised of four basic parts each assigned a letter A,B,C and D. Traditional Medicare when it was originally established was and still is comprised of Parts A and B.

Part A

Medicare Part A is hospitalization insurance. It helps to cover: inpatient hospital stays, skilled nursing facilities, hospice and home health care. Part A is premium free for most people who have been living and working in the US for 10 years or have a spouse that has done so. Its important to know that Part A does not cover long-term (nursing home) care, also know as custodial care.

Additionally, if you don’t have any type of Medicare supplemental insurance, discussed below, then there are deductibles and co-insurance amounts that you are responsible to pay out of pocket. In 2023, the Part A deductible is $1,600 per 60-day benefit period.

Part B

Medicare Part B is medical or doctor coverage with many covered services such as: doctor’s office visits, diagnostic testing, ambulance services, preventative services, durable medical equipment, and many non-self administered medications. To the surprise of many, Part B is not premium free. In 2023 the standard Part B premium is $164.90 per month but can be higher for high income earners. Part B also has an annual deductible of $226 per year. After the deductible is met, Medicare will pay 80% of your covered medical expenses and you are responsible to cover the remaining 20% out of pocket. This is the case, if you do not have Medicare supplemental insurance, described below.

Part C

Medicare Part C is also known as “Medicare Advantage”. It is an optional part of Medicare, offered by private insurance companies. Medicare Advantage Plans offer an alterative way to receive your traditional Medicare coverage. Instead of receiving your traditional Part A and B coverage from the government, you now have a managed care plan similar to an HMO or PPO plan through a private insurance company. To enroll in Part C, you must also be enrolled in Parts A and B and cover the standard Part B premium ($164.90 ca. 2023).

All Medicare Advantage Plans cover the same services as traditional Medicare Parts A and B. However, the private insurance companies are allowed to set their own cost share requirements, co-pays, and co-insurance amounts or out of pocket expenses. These managed care plans typically operate through and limit your choice to a network of doctors and providers in your local area. Many Medicare Advantage plans are zero premium per month, aside from the Part B premium already mentioned. Some include coverage for dental, vision, hearing, fitness facility memberships, and Part D prescription drug plans, discussed next.

Part D

Medicare Part D provides coverage for prescription medications. Part D is only provided by private insurance companies, approved by the federal government. Part D benefits are available as a standalone option in conjunction with traditional Medicare Parts A and B or through a Medicare Advantage plan described above.

Medicare Part D plans can vary on which medications they cover and the co-pay amount. However, even the least expensive Part D plans must cover most generic and brand name medications and cover all or most: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, antineoplastics. Also, coverage is provided for some vaccines like the shingles shot not covered under Medicare Part B.

Its important to know that if Medicare Part D enrollment is delayed then you could potentially face a lifelong Part D late enrollment penalty. Therefore, even if you are taking no or very few medications, its highly encouraged to enroll in a least expensive Part D plan during the initial age 65 open enrollment period.

Medicare Options

Three primary options are available when choosing Medicare coverage.

- Traditional Medicare only (discussed above),

- Medicare Advantage plans (aka Part C, discussed above) and

- Traditional Medicare Parts A and B coupled with Medicare supplementary insurance (also known as medi-gap) plans, discussed next.

Best Medicare Supplement Plans (2023)

Medicare supplement insurance also known as medi-gap insurance is secondary to traditional Medicare benefits. If enrolled in traditional Medicare Parts A and B as your primary insurance coverage, you are entitled to choose any provider that accepts traditional Medicare. This freedom to choose, remains true when medi-gap insurance is purchased, regardless of plan choice. Another importing thing to know is medi-gap insurance is standardized which means plan benefits are always exactly the same regardless of insurance provider. However, the rates can vary quite a bit from insurance provider to another, for example see, Mutual of Omaha, Aetna and United Health Care among others.

Ten standardized medi-gap plans exist. These plans have been designated a letter of the alphabet A through N. Supplement plans A, B, C and D should not be confused with Medicare Parts A, B, C and D, they are not the same thing and unrelated. See the following table for a listing of the ten plans and the corresponding benefits for each plan. Of these ten plans only two or three are currently popular.

Plans F & C

Plan F has been considered the Cadillac plan because it provided the most coverage as can be seen in the chart: 100% of all Medicare Part A and B charges are covered such that you have no deductible, no co-pays, no out-of-pocket responsibility for any Medicare Part A and B coverage service. Unfortunately, Plan F is no longer available for new Medicare enrollees who turn 65 after 1-Jan-2020. Since Plan F is now considered a “closed pool” those “grandfathered in” could be subjected to higher rate increases as time passes which may prove not to be the best value.

Plan C is also no longer available for new Medicare enrollees who turn 65 after 1-Jan-2020 and is considered superseded by Plan D for current and future enrollees.

Plan G

Plan G is nearly identical to Plan F where the only difference is, you are required to pay your Medicare Plan B deductible which is $226 per year (ca. 2023). This means, each year, you pay the first $226 of doctor or outpatient medical costs, then the plan kicks in and provides 100% coverage. In 2023 Plan G is the most popular plan and it is also the most comprehensive supplement plan available to current and future enrollees. In many parts of the US it is considered an excellent value when the amount of coverage provided is considered.

Plan G “high deductible”, is a version of Plan G that provides the same benefits as Plan G but with a higher deductible and is popular in 2023. When shopping for this coverage rates can vary from state to state and between providers. In some instances Plan G “high deductible” may be the plan of choice.

Plan N

Plan N is very similar to Plan G. Two things make it different. On Plan N you are responsible for office visit co-pays (up to $20 per visit). Whereas on Plan G once the deductible is met there are no co-pays. The other difference with Plan N is it does not cover Medicare Part B excess charges. These excess charges are pretty rare and shouldn’t be considered a big deterrent against choosing Plan N in many parts of the country. Plan N is notably less expensive than Plan G especially if you wont have many office visits. Plan N is considered a value plan that could keep your monthly premiums and down.

Words of Caution

Generally, Medicare supplement plans are medically underwritten. However, when you are new to Medicare and first enroll in Medicare Part B, everyone gets a one-time Medicare supplement open enrollment window up to 6 months after your Part B effective date. Enrollment beyond this period requires medical underwriting to qualify for a supplement plan. This is not the case in all states but most. Therefore, to enroll or change elections outside of the initial open enrollment, the insurance carrier will ask a series of health questions and examine your medical history to determine if they will approve you for their plan. So when you choose a supplement plan (or Traditional Medicare Parts A & B only or a Medicare Part C Advantage Plan) its important to note you may be able to change your elections in the future, but it’s not guaranteed though and will be dependent upon your health.

Medicare Cost Estimate

Two Options

Option 1 – Original Medicare plus Supplement

Monthly Costs:

- $164.90 Part B

- $120 Supplement Plan

- $20 Part D

$304.90 per month total

$226 per year – Part B deductible (prescription drug co-pays not included)

Option 2 – Medicare Advantage Plan (Part C)

Monthly Costs:

- $164.90 Part B

- $0 Advantage Plan

$164.90 per month total

$5000 to $7000 per year, max out-of-pocket

Married Couples

Medicare has no family plans, meaning that you and your spouse must enroll for benefits separately. This also means spouses pay separate Medicare premiums and are subject to their own deductible schedules.

You may need to enroll at different times, depending on your age and health. While Medicare considers you individually as beneficiaries, your marital status can influence some of your Medicare costs.

Medicare Part A

Most Medicare beneficiaries don’t’ pay monthly premiums for Medicare Part A. You will qualify for premium free Part A if:

- You worked and paid Medicare taxes for a cumulative of 10 years.

- You had Medicare-covered government employment.

- You have been married to someone with a qualifying work history for at least 12 months.

Medicare Part B

Medicare considers your joint income, if filing taxes jointly. In most cases you’ll pay the standard monthly premium of $164.90 per month in 2023 unless your joint income (two years ago 2021) was above $194,000 in which case your monthly premiums will be higher, by an amount known as income related adjustment amount or IRMAA.

Things Medicare Doesn’t Cover

Eye Exams

Medicare doesn’t cover eye exams so while traditional Medicare does cover things like cataract surgery and glaucoma treatment it does not cover routine eye examinations or glasses or contact lenses in general some Medicare advantage plans do include some vision benefits however for some people it will make sense to buy a vision insurance policy to help offset the cost of your eye exams glasses or contacts but you’ll want to be aware that most vision plans do have a cap or an annual maximum benefit a total amount that the plan will pay per year towards your glasses or contacts and that’s usually around $150 to $200 a year so you want to go ahead and weigh your expected vision expenses to see if a plan like that would be worthwhile.

Hearing Aids

Medicare does cover ear related medical conditions but traditional Medicare does not cover routine hearing tests or hearing aids now if you have a Medicare advantage plan you will want to go ahead

and check your policy benefits to see if it covers any of your hearing related needs if it doesn’t or if you just have traditional Medicare then you can look into purchasing a discount plan that may help reduce the cost of your hearing aids.

Congress passed legislation a few years back that allows some hearing aids to be sold over the counter or you can pay as you go.

Dental Services

Medicare does not cover dental exams or dental work. In general some Medicare advantage plans will include some dental benefits you can also purchase a standalone dental plan there are dental discount plans available that are really popular with many seniors and there are also dental vision hearing combo plans and those are becoming more and more popular to help cover some of these big expenses related to dental vision hearing.

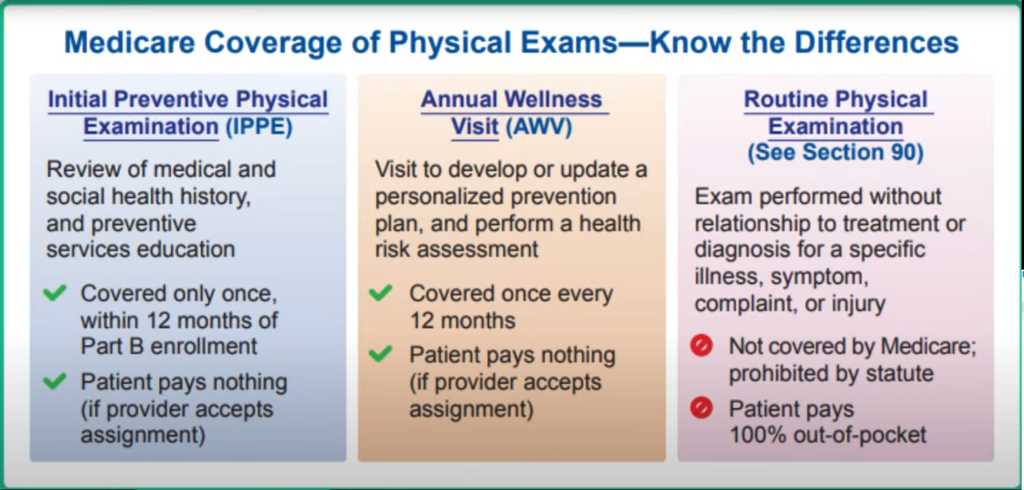

Full Routine Annual Physical Examination

Traditional Medicare has limited coverage for a full routine annual physical examination that includes blood work. Many people are surprised to learn this when they get onto Medicare. Medicare instead covers what they call a Medicare wellness exam which is pared down version of a routine physical examination. In the chart below, see some of the differences between a routine physical examination which is not covered by traditional medicare and an annual Medicare well check which Medicare does cover at 100 percent.

In order to avoid unexpected medical bills you’ll want to be sure that when you are going into your doctor for your annual checkup that you’re telling your doctor’s office that you want your annual Medicare wellness exam not a full routine physical examination now if you do want a full routine physical exam that includes the blood work, then you may be responsible for some or all of the costs depending on your plan.

Additionally the medical community has recently questioned the value of these full routine physical examinations in recent years and this is due in part to over testing false positives and unnecessary medical costs so you will need to decide if you want to get a full routine physical examination based on your needs your plan your budget but it is important to take advantage of your Medicare benefits and at least get your Medicare wellness exam each year because that is covered at 100%

Nursing Home or Long Term Care

Finally, Medicare doesn’t cover nursing home care or long-term care. Medicare will cover a limited stay in a skilled nursing facility. Let’s say for example you break a bone or you have a hip replacement and you need inpatient rehabilitation, Medicare will cover your stay in a skilled nursing facility.

In general however when you need just help with the activities of daily living custodial care they call it help with your bathing toileting dressing etc that’s going to be considered long-term care and that is not covered by Medicare or Medicare advantage plans and in many parts of the country the average annual costs in a nursing home are going to be about $90K to $100K per year so it is a big expense.

Planning for your nursing care is a pretty big deal whether you are budgeting and saving or looking to purchase maybe a long-term care insurance policy for many people with limited income and savings, Medicaid is really going to help to fill in those gaps but I recommend speaking with a financial advisor to help you plan out for these potential future expenses so while these aren’t the only things that Medicare doesn’t cover, these are five of the really big ones.